We’ve got what you need for PCI DSS compliance.

If you’re looking to accept credit or debit card payments, you need to meet certain payment card security standards – PCI compliance – to ensure your customers’ information is protected. When we process payments for you, you can spend less time detailing with data security and more time growing your business.

Get Started Now

What it’s all about.

PCI DSS (Payment Card Industry Data Security Standard) is a set of comprehensive requirements that all businesses who handle credit and debit payments must comply with, regardless of size or number of transactions they process. The requirements for maintaining PCI compliance include completion of an annual PCI self-assessment questionnaire and a quarterly network scan.

Committed to data integrity.

PayPal has achieved PCI DSS compliance certification under various programs and standards.* This underscores our commitment to security and the protection and integrity of customer data.

*The Visa Cardholder Information Security Program, MasterCard Site Data Protection Program and American Institute of Certified Public Accountant's Statement of Auditing Standards #70 (SAS70) certification.

Grow customer trust.

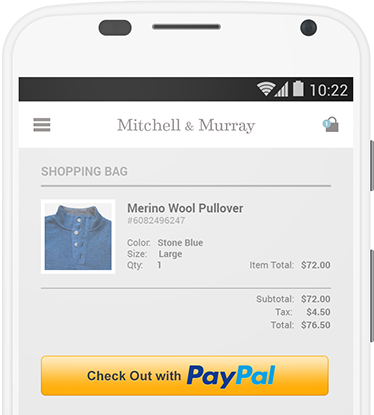

PayPal stores customers’ credit and debit card account information. We don’t even share it with you, so you don’t need to worry about putting their data at risk. By accepting PayPal, you’re telling your customers you take their data security seriously.

When you need to be PCI compliant.

If you manage transactions yourself and touch, store, or transmit credit card details, you’ll need to obtain PCI compliance certification for your business. For many of our products, we handle this for you, but if you have one of our more customisable solutions, like Payflow Pro, or you accept non-PayPal payments, you’ll need to be compliant. For help you can contact a certified security expert like Trustwave.